ABS is a commonly used thermoplastic engineering plastic with good comprehensive performance and wide use. It can be widely used in electronic and electrical appliances, instruments, automobile manufacturing, office machinery and daily products.

There are many production methods of ABS, and the current industrial production technologies include emulsion grafting polymerization, emulsion grafting blending and continuous bulk polymerization. At present, the main methods of ABS production are emulsion grafting – bulk SAN blending and continuous bulk grafting polymerization.

Among them, the emulsion graft-bulk SAN blending method is the most important technology for ABS resin production, with advanced and reliable technology, wide product range, good performance and small pollution. Continuous bulk polymerization method has the advantages of less discharge of industrial sewage, high product purity, small plant investment, low production cost, and has great potential for development.

This paper analyzes the data of ABS production capacity, output, consumption, import and export volume from two dimensions of global and China, and forecasts the supply and demand situation of ABS combined with the current situation.

1. Analysis and forecast of global ABS supply and demand

1.1 Supply and demand situation

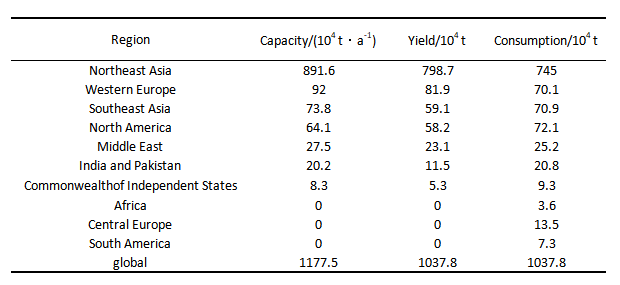

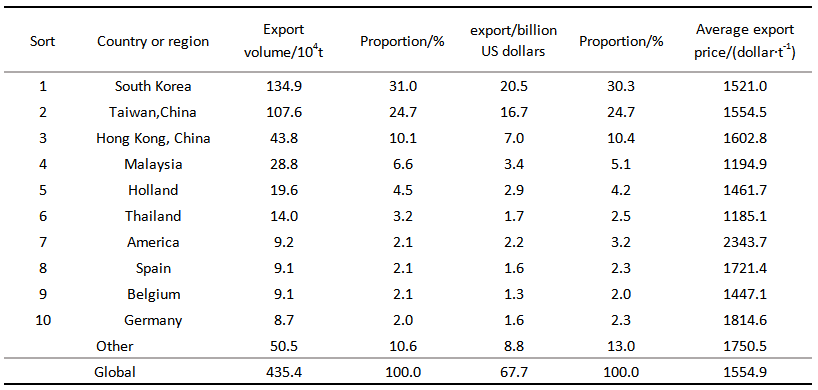

ABS production capacity is mainly distributed in Asia, North America and Europe, among which the capacity of Asia is significantly higher than that of other regions. In recent years, global ABS production capacity has grown steadily, and Northeast Asia accounts for the largest proportion of ABS production capacity in the world. In 2021, the global ABS production capacity, output and consumption, respectively is 1177.5 x 10 ⁴, 1037.8 x 10 ⁴ and 41037.8 x 10 ⁴ t/a (see table 1). The global ABS operating rate in 2021 was about 88.1%, an increase of about 5.8 percentage points over the previous year.

Table 1 Global ABS supply and demand in 2021

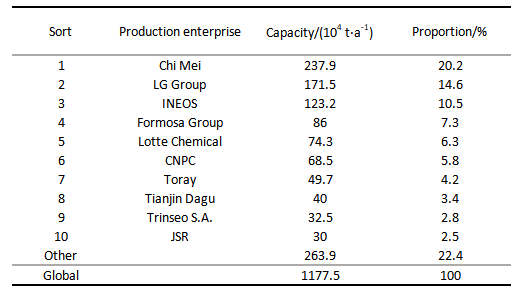

The 2021 global top 10 ABS production enterprise combined capacity of 913.6 x 10 ⁴ t/a, accounted for 77.6% of capacity, ABS capacity more concentrated. Among them, Taiwan’s Chimei is the world’s largest in terms of production capacity, while LG Group and Ineos rank second and third respectively (see table 2).

Table 2 Top 10 global ABS manufacturers in 2021

ABS resin picture source: Chimei

picture source: LG chem

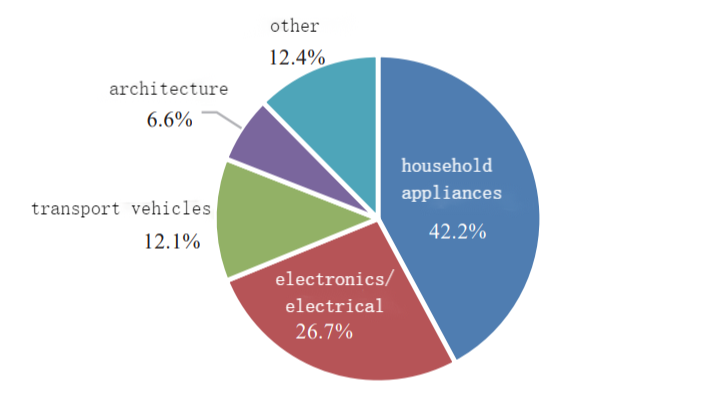

ABS is mainly used in household appliances, electronics/electrical, and transport vehicles, accounting for 42.2%, 26.7% and 12.1% of total consumption in 2021, respectively (see figure 1).

Figure 1 Global ABS consumption structure in 2021

1.2 Current situation of global trade

The total international trade volume of ABS in 2020 was 6.77 billion US dollars, a decrease of 14.1% year on year; Total trade volume of 435.4 x 10 ⁴ t, down 9.3% year on year. In terms of price, the average export price of global ABS in 2020 is $1554.9 /t, decreasing by 5.3% year-on-year.

1.2.1 Import situation

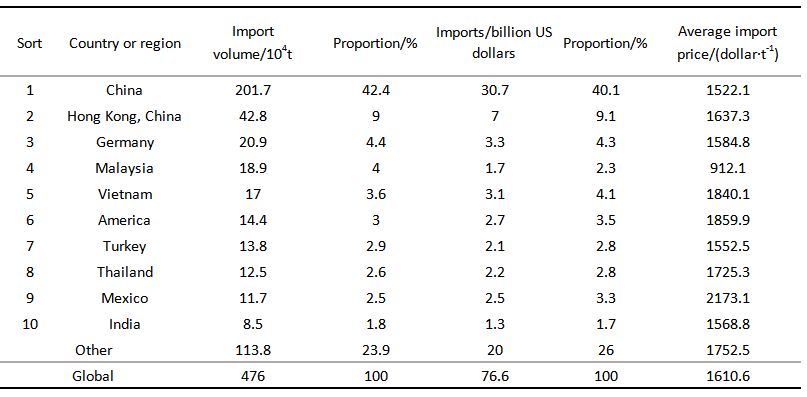

In 2020, the country or region with the largest ABS import volume is China, followed by Hong Kong, China, and Germany ranks the third. The import volume of the three countries together accounts for 55.8% of the global total import volume (see Table 3).

Table 3 Top 10 ABS importing countries or regions in the world in 2020

1.2.2Export situation

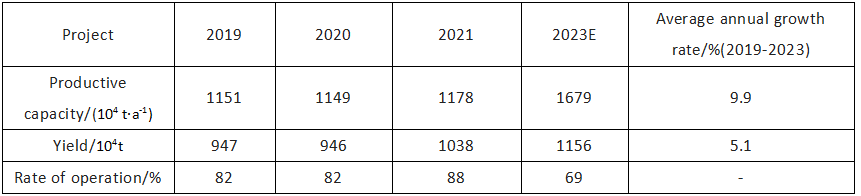

In 2020, Korea ranked first in ABS export in the world. Taiwan followed, followed by Hong Kong. Together they account for 65.8% of global trade (see table 4).

Table 4 Top 10 ABS exporting countries or regions in the world in 2020

1.2.3Supply and demand forecast

Global ABS production capacity is growing rapidly. The next two years, the world will add ABS production capacity of 501 x 10 ⁴ t/a, new capacity mainly in northeast Asia, southeast Asia and North America and other regions. Among them, Northeast Asia will account for 96.6% of the total new capacity. Is expected in 2023, the world of ABS production capacity will reach 1679 x 10 ⁴ t/a, 2019-2023 average annual growth of 9.9%.

With the gradual recovery of the world economy and the increasing demand for downstream household appliances, electronics/electrical, etc., the new demand for ABS will mainly come from Northeast Asia, Southeast Asia and Western Europe in the next two years. Among them, Northeast Asia’s new demand will account for 78.6% of the total new demand.

The growing demand of the downstream market also puts forward higher requirements for ABS manufacturers, and ABS will develop more towards high-end products. By 2023, demand of ABS is expected to reach 1156 by 10 ⁴ t/a, 2019-2023 annual demand growth of 5.1% (see table 5).

Table 5 Current situation and forecast of global ABS supply and demand from 2019 to 2023

2 Current situation and forecast of ABS supply and demand in China

2.1China’s current production capacity

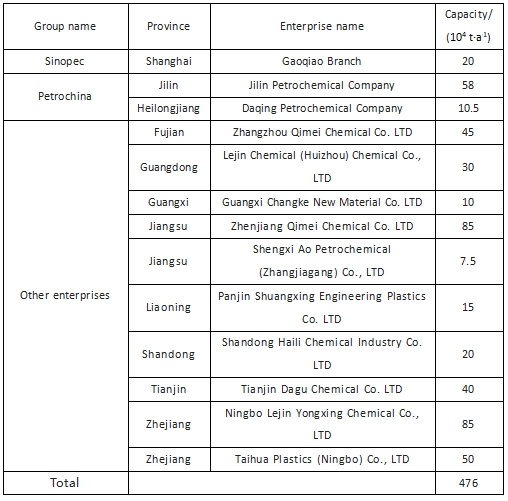

By the end of 2021, China’s ABS production capacity has reached 476.0 x 10 ⁴ t/a, up 12.7% from a year earlier, the new capacity mainly from zhangzhou chimei chemical company. It is worth mentioning that foreign-funded enterprises play an important role in the production of ABS in China. The four largest ABS manufacturers in China are foreign-funded enterprises, namely Ningbo Lejin Yongxing Chemical Co., LTD., Zhenjiang Qimei Chemical Co., LTD., Taihua Plastics (Ningbo) Co., LTD., and Zhangzhou Qimei Chemical Co., LTD. Together these four companies will account for 55.7% of China’s total capacity in 2021 (see table 6).

Table 6 Capacity of major ABS manufacturers in China in 2021

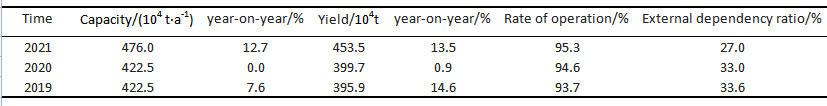

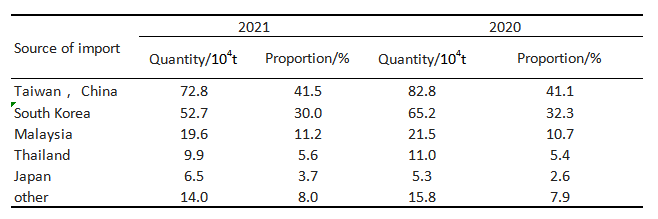

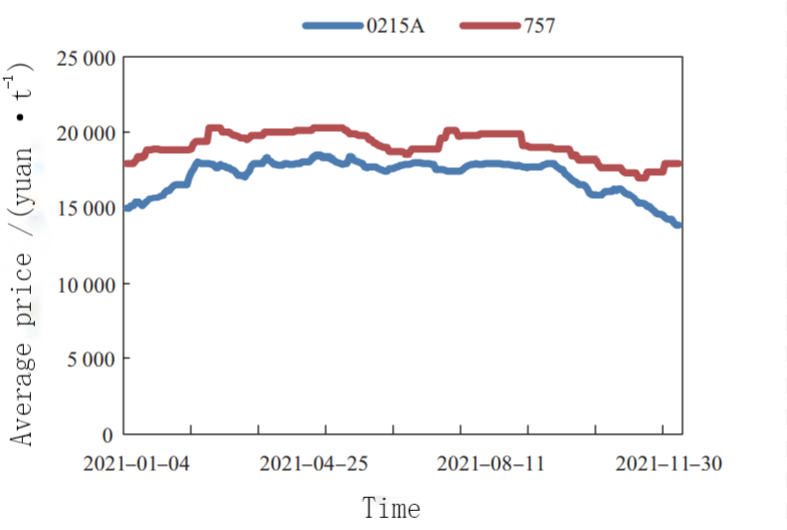

In 2021 China’s ABS production of 453.5 x 10 ⁴ t, year-on-year growth of 13.5%; External dependency was 27.0%, down 6% year-on-year (see table 7).

Table 7 Statistics of ABS production in China from 2019 to 2021

2.2Import and export status

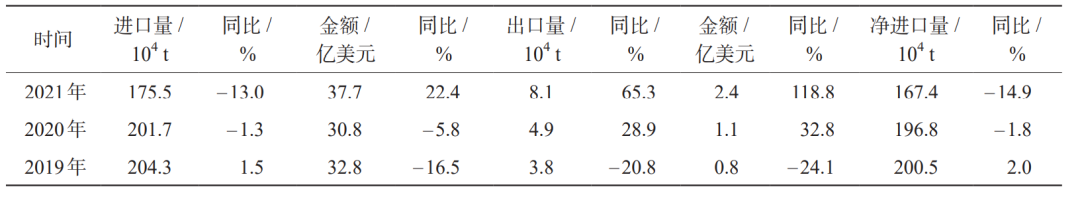

In 2021, China’s ABS imports of 175.5 x 10 ⁴ t, down 13.0% year on year, the import amount is $3.77 billion, up 22.4% from a year earlier. ABS exports in 2021 to 8.1 x 10 ⁴ t and export amount is $240 million, exports and exports are a substantial growth (see table 8).

Table 8 Statistics of imports and exports of ABS in China from 2019 to 2021

2.2.1Import situation

In terms of trade mode, ABS imports mainly include general trade and feed processing trade. In 2021 China imported ABS general trade for the 93.9 x 10 ⁴ t, accounted for 53.5% of total imports. Followed by the feed processing trade, trade amounted to 66.9 x 10 ⁴ t, accounted for 38.1% of total imports.In addition, bonded warehouse transit goods, processing and assembly trade of incoming materials accounted for 4.1% and 3.1% respectively of the total import volume.

According to the import source statistics, in 2021, China’s ABS imports will mainly come from Taiwan, South Korea and Malaysia. The combined imports of these three countries or regions accounted for 82.7% of the total imports (see table 9).

Table 9 Statistics of sources of ABS import in China from 2020 to 2021

2.2.2Export situation

In 2021, Chinese exports ABS 8.1 x 10 ⁴ t. The main trade modes were processing trade of imported materials and general trade, accounting for 56.3% and 35.2% of total exports respectively. Export destinations are mainly concentrated in Vietnam, accounting for 18.2 percent of total exports, followed by Malaysia and Thailand, accounting for 11.8 percent and 11.6 percent of total exports respectively.

2.3Consumption situation

In 2021, China’s ABS apparent consumption of 620.9 x 10 ⁴ t, rose 24.4 x 10 ⁴ t, growth rate of 4.1%; The self-sufficiency rate was 73.0%, up 6% from the previous year (see table 10).

Table 10 Apparent consumption statistics of ABS in China from 2019 to 2021

The downstream consumption of ABS in China is mainly concentrated in household appliances, office equipment, daily necessities, automobiles and other fields. In 2021, the downstream proportion of ABS in China changed slightly. Among them, household appliances are still the largest downstream application field of ABS, accounting for 62% of the total consumption of ABS. Next came transportation, accounting for about 11 percent. Daily necessities and office equipment accounted for 10% and 8%, respectively

.

ABS plastic home appliance housing

ABS plastic auto parts

Photo source: Zhongxin Huamei

Looking into the Chinese market, with the development of leisure products such as yachts and mobile homes, ABS market has opened a new market; In the building materials market such as pipes and fittings, ABS also has a place because of its excellent performance.At the same time, ABS also has a good market prospect in the application of medical devices and alloy blends. At present, the application proportion of ABS in the fields of building materials, medical instruments and alloy blends in China is small,which needs to be further developed in the future.

Medical equipment ABS

Photo source: Fusheng New Materials

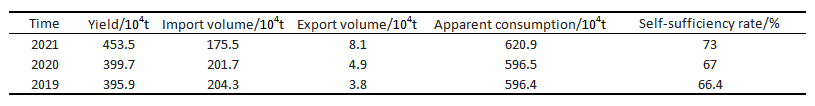

2.4 Analysis of ABS price in China

In 2021, the overall trend of China’s ABS market is first rising, then falling, then oscillating and finally falling sharply. Taking Yuyao market price as an example, the highest price of ABS (0215A) was 18,500 yuan /t in May, and the lowest price was 13,800 yuan /t in December. The price difference between high and low prices was 4,700 yuan /t, and the annual average price was 17,173 yuan /t. The highest price of ABS (757) was 20,300 yuan /t in March, the lowest was 17,000 yuan /t in December, the difference between high and low prices was 3,300 yuan /t, and the annual average price was 19,129 yuan /t.

ABS price returned to the high in the first quarter; Prices fell slowly in the second quarter; The market in the third quarter was an interval shock trend; In the fourth quarter, due to the influence of factors such as dual control and power limiting, it was difficult to improve the downstream operation, and ABS prices fell sharply (see figure 2).

Figure 2 Market price trend of ABS in China’s mainstream market in 2021

2.5Supply and demand forecast

2.5.1Supply forecast

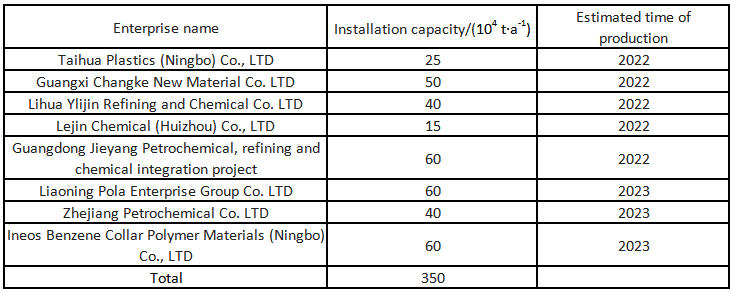

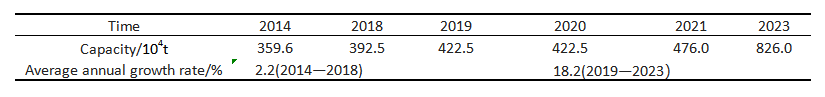

High profits attract more enterprises to enter the ABS industry, and China’s ABS will enter the peak of production. According to incomplete statistics, in 2022-2023, China will add 8 sets of ABS device, the new capacity is 350 x 10 ⁴ t/a. By 2023, China’s ABS production capacity is expected to reach 826 by 10 ⁴ t/a (see table 11), ABS production growth is expected to China from 2014-2.2% in 2018 to 2019-18.2% in 2023 (see table 12).

Table 11 Statistics of China’s new ABS production capacity from 2022 to 2023

Table 12 Forecast of ABS capacity growth in China

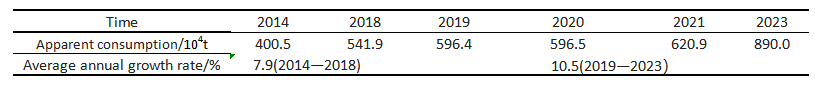

2.5.2Demand forecast

The demand for ABS is mainly concentrated in the household appliance industry and the automobile industry. With the improvement of the product quality requirements, the replacement amount of ABS to HIPS and other materials will be more and more large. With the steady development of China’s electronic and electrical industry, coupled with the continuous development of automobile and other light industry, the demand for ABS will grow steadily in the future. ABS apparent consumption by 2023, China is expected to reach 890 by about 10 ⁴ t (see table 13).

Table 13 Forecast of apparent consumption growth of China’s ABS

3 Conclusion and suggestion

(1) Northeast Asia will continue to play a key role in leading the growth of global ABS demand. Meanwhile, Northeast Asia is also a major supply source for the rest of the world. The potential growth of household appliances and electronic appliances industry will drive the rapid growth of ABS consumption.

(2) In the next few years, there will be a lot of new ABS production capacity in China, more enterprises will enter the ABS industry, ABS production will be significantly increased, the supply pattern may be greatly changed, then the domestic supply gap will be made up.

(3) China’s ABS products are mainly general purpose materials, and high-end products still need to be imported in large quantities. ABS manufacturers should make efforts in management and technological innovation, create a differentiated and high-end development route, and avoid homogeneous product competition.

Reference: Analysis and Forecast of global ABS supply and demand in recent years, Chang Min et al

Post time: Feb-21-2023